Child & Dependent Care Tax Credit

Child & Dependent Care Tax Credit

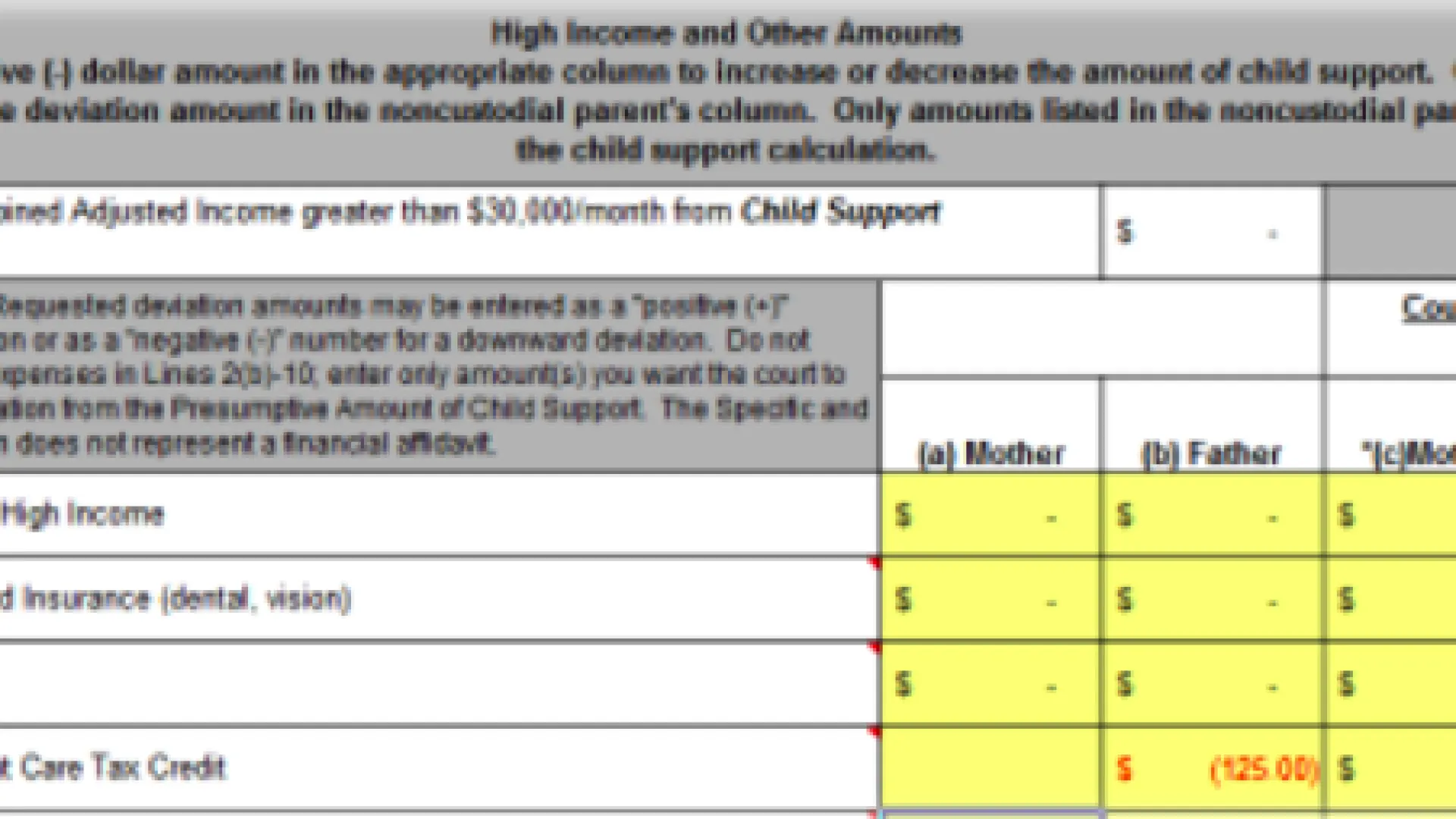

In Georgia, the court presiding over a family law matter regarding the determination of child support may deviate from the presumptive child support amount calculated by the child support worksheets for several reasons. These discretionary or non-mandatory deviations are found in Schedule E of Georgia's Child Support Worksheet. The fifth on-mandatory deviation, found on line 5 of Schedule E, is the Child and Dependent Care Tax Credit. According to Georgia's statutory law, the Child and dependent Care Tax Credit is applicable "If the court or the jury finds that one of the parents is entitled to the Child and Dependent Care Tax Credit, the court or the jury may deviate from the presumptive amount of child support in consideration of such credit." O.C.G.A. § 19-6-15(i)(2)(E).

The Child and Dependent Care Tax Credit is a federal tax credit that may be claimed by a parent if that parent paid someone to care for his or her child or a dependent so he or she could work or look for work. If this tax credit is claimed, it subtracted from the amount of taxes that parent owes, thus reducing his or her tax liability. As a child can only be claimed as a dependent once, after a divorce, only one parent is entitled to this tax credit for each child. The parent awarded primary physical custody is generally entitled to claim this credit. However, the parents may negotiate this issue as a part of their settlement agreement discussions. Once it is determined which parent will claim this tax credit, the court "may deviate from the presumptive amount of child support in consideration of such credit." Id. For example, one way to utilize this deviation would be the following:

Non-custodial Mother claims the Child and Dependent Care Tax Credit. The credit amount is $1,500. As a result, non-custodial Father seeks a negative deviation in the amount of $125, thus reducing his monthly child support obligation by $125 per month. This deviation amount is calculated by prorating the credit amount received by Mother over 12 months.

For more information regarding the Child and Dependent Credit Tax Credit, see the ten tax tips regarding claiming the Child and Dependent Care Tax Credit published by the IRS.

- If you paid someone to care for your child, dependent or spouse last year, you may qualify for the child and dependent care credit. You claim the credit when you file your federal income tax return.

- You can claim the Child and Dependent Care Credit for "qualifying individuals." A qualifying individual includes your child under age 13. It also includes your spouse or dependent who lived with you for more than half the year who was physically or mentally incapable of self-care.

- The care must have been provided so you - and your spouse if you are married filing jointly - could work or look for work.

- You, and your spouse if you file jointly, must have earned income, such as income from a job. A special rule applies for a spouse who is a student or not able to care for himself or herself.

- Payments for care cannot go to your spouse, the parent of your qualifying person or to someone you can claim as a dependent on your return. Payments can also not go to your child who is under age 19, even if the child is not your dependent.

- This credit can be worth up to 35 percent of your qualifying costs for care, depending upon your income. When figuring the amount of your credit, you can claim up to $3,000 of your total costs if you have one qualifying individual. If you have two or more qualifying individuals you can claim up to $6,000 of your costs.

- If your employer provides dependent care benefits, special rules apply. See Form 2441, Child and Dependent Care Expenses for how the rules apply to you.

- You must include the Social Security number on your tax return for each qualifying individual.

- You must also include on your tax return the name, address and Social Security number (individuals) or Employer Identification Number (businesses) of your care provider.

- To claim the credit, attach Form 2441 to your tax return. If you use IRS e-file to prepare and file your return, the software will do this for you.

IRS Tax Tip 2013-34, March 15, 2013.