Child Care

Child Care

The

second Adjustment to the Basic Child Support Obligation is Work Related Child

Care. Adjustments to the Child Support Obligation are sometimes referred to by attorneys as Mandatory Child Support Deviations. While Work Related Child Care is normally included in the child support

worksheet, Georgia law changed in 2018 to allow that where the childcare

expense varies, it may be handled outside of the worksheet. If the childcare

expense is handled outside of the worksheet, each party pays a percentage

of the childcare and it is enforceable by the same means as child support.

According to Georgia's Companion Guide to the Child Support Worksheet and Schedules, Work Related Child Care costs are "expenses for the care of the child for whom support is being determined which are due to employment of either parent." Additionally, childcare costs incurred while a parent is searching for reemployment or costs associated with educational training necessary for a parent to obtain a job or increase his or her earning potential may also be viewed as Work Related Child Care costs for the purpose of the child support calculation. However, before an Adjustment to the Basic Child Support Obligation may be made based on a parent's asserted Work Related Child Care costs, the presiding judge must determine that the expenses are appropriate given the parent's relative financial abilities. If deemed appropriate, the Work Related Child Care costs will be reflected in the child support calculation and adjust the Basic Child Support Obligation either upward or downward.

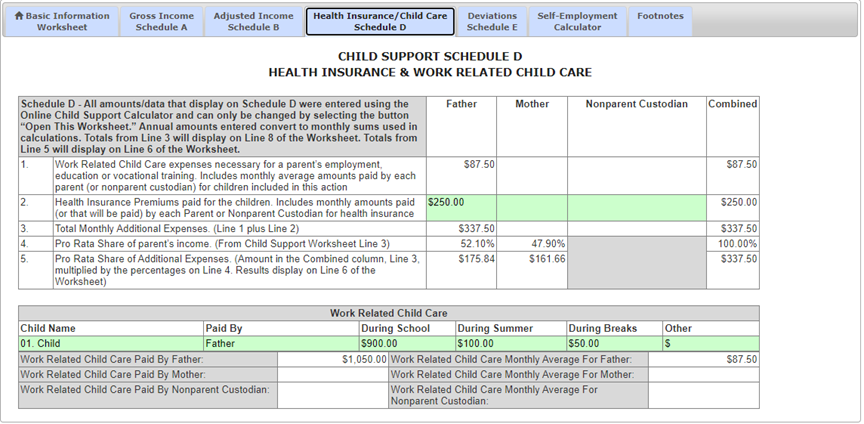

As with the Adjustment based on Health Insurance Premiums paid by either parent, the Work Related Child Care expense is also found in Schedule D of Georgia's Child Support Worksheet. Specifically, this Adjustment is listed on line 1 of Schedule D and is titled "Work Related Child Care expenses necessary for parent's employment, education or vocational training."

The notes in line 1 of Schedule D, indicate the average amount paid by each parent monthly for Work Related Child Care costs and should be reflected in the appropriate fields. To populate these fields, it is necessary to complete Supplemental Table 1, which is also found in Schedule D. A graphic example and explanation of this table is below.

Similar to the Health Insurance Adjustment, the Work Related Child Care expense is not a "dollar for dollar" Adjustment, but is made to the presumptive child support amount based on the parent's pro rata share of the Basic Child Support Obligation. Not only should the total yearly childcare expenses be separated by type of expense, (i.e. amounts paid during school year, summer break or school breaks), but the amounts should also be separated according to which child the expense should be attributed. To obtain a downloadable version of Georgia's Child Support Calculator, visit the Georgia Child Support Commission's website. To learn more about child support in Georgia, Georgia's Child Support Worksheet, or how to complete a child support worksheet, see our articles addressing these topics.